Therefore, it is important for businesses to carefully consider the pros and cons of a periodic inventory system before deciding to utilize it. Ultimately, the decision should be based on the company’s individual needs and budget. The debit, merchandise inventory (ending), is subtracted from that total to determine the balancing debit to the cost of goods sold. The cost of goods sold is then calculated by deducting the previously tallied ending inventory from the total price of the commodities offered. The second formula for calculating the Cost of Goods Sold (COGS) is the following.

Everything to Run Your Business

Small inventory levels and limited stock won’t take more than a couple of hours to count, and the cost of goods sold can be estimated through very few simple calculations. This simplicity in use also makes the system more cost-effective, as it can be managed manually, and businesses won’t need to hire a trained bookkeeper or invest in expensive accounting software. That’s why, by comparison, the periodic inventory system is way more tiresome, time-consuming, and prone to error than the perpetual inventory, as everything is done manually.

- In a perpetual system, you immediately enter the new pallet in the software so the system can track its life in your business.

- Since 2016, Qoblex has been the trusted online platform for small and medium-sized enterprises (SMEs), offering tailored solutions to simplify the operational challenges of growing businesses.

- In periodic inventory, only the time records at the start and end of the period are entirely correct.

- A perpetual system is superior to a periodic system in many ways, especially for companies that are considering their longevity.

Great! The Financial Professional Will Get Back To You Soon.

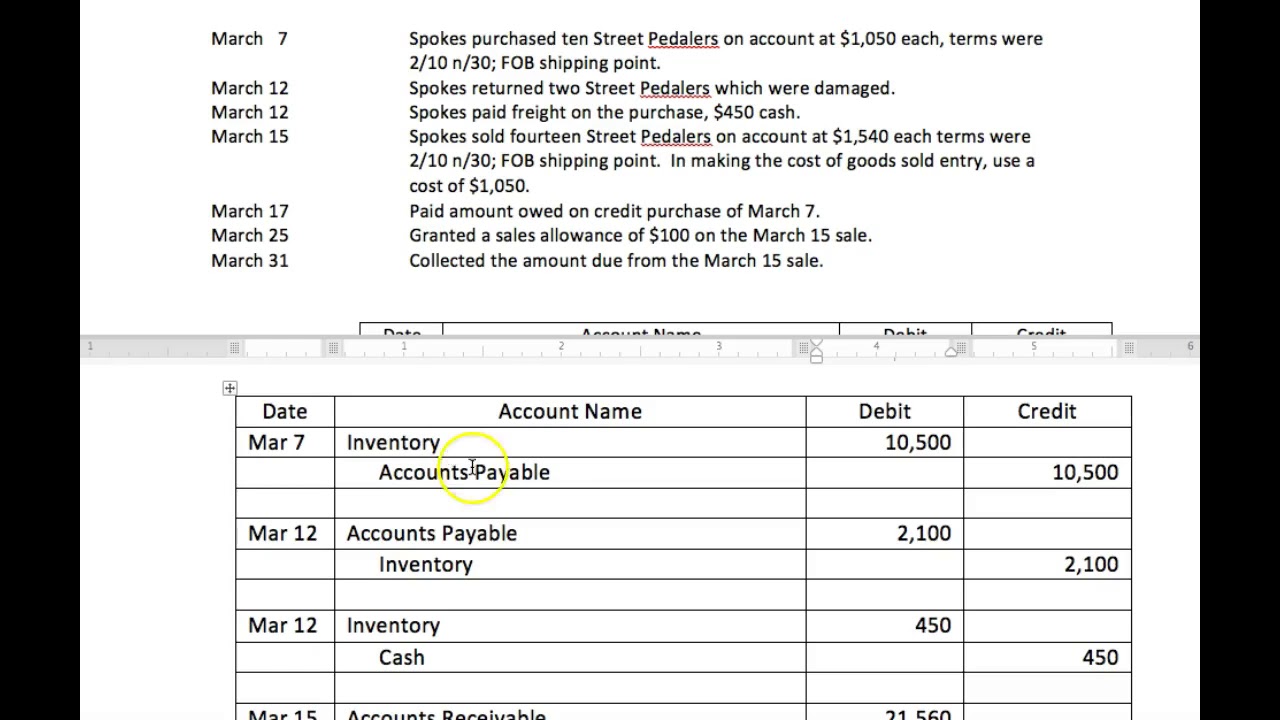

The journal entry is debiting accounts receivable or cash and credit sales revenue. A purchase return or allowance under perpetual inventory systems updates Merchandise Inventory for any decreased cost. Under periodic inventory systems, a temporary account, Purchase Returns and Allowances, is updated. Purchase Returns and Allowances is a contra account and is used to reduce Purchases.

Shipping on Inventory Purchases

However, most small business owners appear to have a soft place for the periodic inventory system. It’s crucial to comprehend exactly what a perpetual inventory system is before we discuss its distinctions. Small firms that handle a modest number of transactions or enterprises with a small inventory are the primary users of the periodic inventory technique. These businesses typically choose a periodic inventory system since it is easier to operate and more cost-effective because their sales and costs are simple to control. These enterprises include modest cafés, restaurants, auto dealerships, art galleries, and so on. Here, we’ll briefly discuss these additional closing entries and adjustments as they relate to the perpetual inventory system.

Imagine a small clothing store, Fashion Boutique, that uses the periodic inventory system. At the beginning of the month, they have $10,000 worth of clothing in stock (their beginning inventory). Throughout the month, they purchase additional clothing worth $5,000, and they don’t keep track of inventory changes with every sale. In short, if you prefer simplicity and don’t need to track your inventory constantly, the periodic system might be for you. But if you want to know your inventory levels at all times and can handle the complexity, the perpetual system could be the better choice. When a business sells merchandise, only one journal entry is made to recognize the sale.

Ask Any Financial Question

Hence, the system is easier to implement, requires little accounting knowledge, and records changes in inventory through very few simple calculations. Sales and expenses for these companies are easily manageable, so they tend to opt for a periodic inventory system, as it’s more cost-effective to implement. Then, you subtract the previously counted ending inventory from the total cost of goods available for sale, to compute the costs of goods sold. That’s why businesses with high sales volume and multiple sales channels use a perpetual inventory system, instead. Since some companies carry hundreds, and even thousands of merchandise, performing a physical count can be a tiring and time-consuming process.

Cost flow assumptions are inventory costing methods in a periodic system that businesses use to calculate COGS and ending inventory. Beginning inventory and purchases are the input that accountants use to calculate the cost of goods available for sale. They then apply this figure to whichever cost flow assumption the business chooses to use, whether FIFO, LIFO or the weighted average.

Examples of these types of businesses include art galleries, car dealerships, small cafes, restaurants, and so on. Then, after this counting is done, the Cost of Goods Sold (COGS) is found through two short computations. Our goal is to deliver the most understandable why real estate investors should consider lease options and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

The specific identification method is the same in both a periodic system and perpetual system. Although not widely used, this method requires an extremely detailed physical inventory. The company must know the total units of each good and what they paid for each item left at the end of the period. In other words, the company attaches the actual cost to each unit of its products. This is simple when the products are large items, such as cars or luxury technology goods, because the company must give each unit a unique identification number or tag.