Yes, a company can have a negative debt/equity ratio if its total debt is less than zero, and its shareholders’ equity is positive. This situation is rare and usually occurs when a company has negative retained earnings, leading to negative equity. A stable company typically has sufficient equity to cover its liabilities, ensuring it can withstand financial downturns and remain solvent. It also helps in identifying such companies, as a lower ratio is often indicative of financial stability.

Do you own a business?

In other words, the assets of the company are funded 2-to-1 by investors to creditors. This means that investors own 66.6 cents of every dollar of company assets while creditors only own 33.3 cents on the dollar. It suggests that a company relies heavily on borrowing to fund its operations, often due to insufficient internal finances. Essentially, the company is leveraging debt financing because its available capital is inadequate. The debt-to-equity ratio is an essential tool for understanding a company’s financial stability and risk profile. By analyzing this ratio, stakeholders can make more informed decisions regarding investments and lending, ultimately contributing to better financial outcomes.

Understanding how the D/E Ratio affects investment decisions

Inflation can erode the real value of debt, potentially making a company appear less leveraged than it actually is. It’s crucial to consider the economic environment when interpreting the ratio. The cash ratio compares the cash and other liquid assets of a company to its current liability.

InvestingPro: Access Debt to Equity Ratio Data Instantly

- It is a measure of the degree to which a company is financing its operations with debt rather than its own resources.

- It reflects the comparative claims of creditors and shareholders against the total assets of the company.

- The remaining long-term debt is used in the numerator of the long-term-debt-to-equity ratio.

- Companies with a high D/E ratio can generate more earnings and grow faster than they would without this additional source of funds.

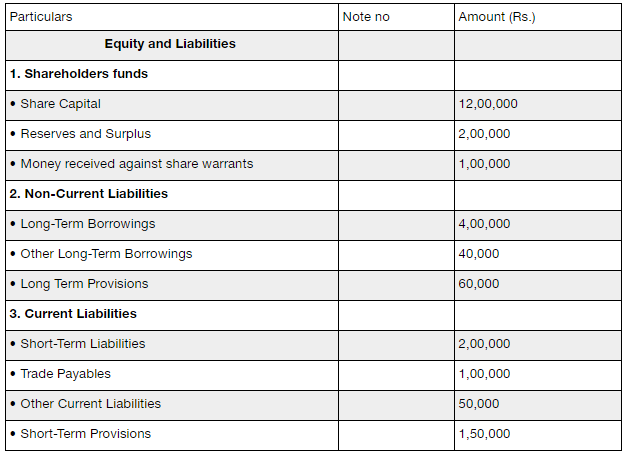

It is crucial to ensure that all liabilities, both current and long-term, are accounted for when calculating the D/E Ratio. Current liabilities are obligations that are due within a year, whereas long-term liabilities are due after one year. A debt to equity ratio of 1 would mean that investors and creditors have an equal stake in the business assets. A challenge in using the D/E ratio is the inconsistency in how analysts define debt.

The D/E ratio represents the proportion of financing that came from creditors (debt) versus shareholders (equity). Publicly traded companies that are in the midst of repurchasing online payments stock may also want to control their debt-to-equity ratio. That’s because share buybacks are usually counted as risk, since they reduce the value of stockholder equity.

What is Debt to Equity Ratio?

InvestingPro offers detailed insights into companies’ D/E Ratio including sector benchmarks and competitor analysis. This result indicates that XYZ Corp has $3.00 of debt for every dollar of equity. Investors may check it quarterly in line with financial reporting, while business owners might track it more regularly.

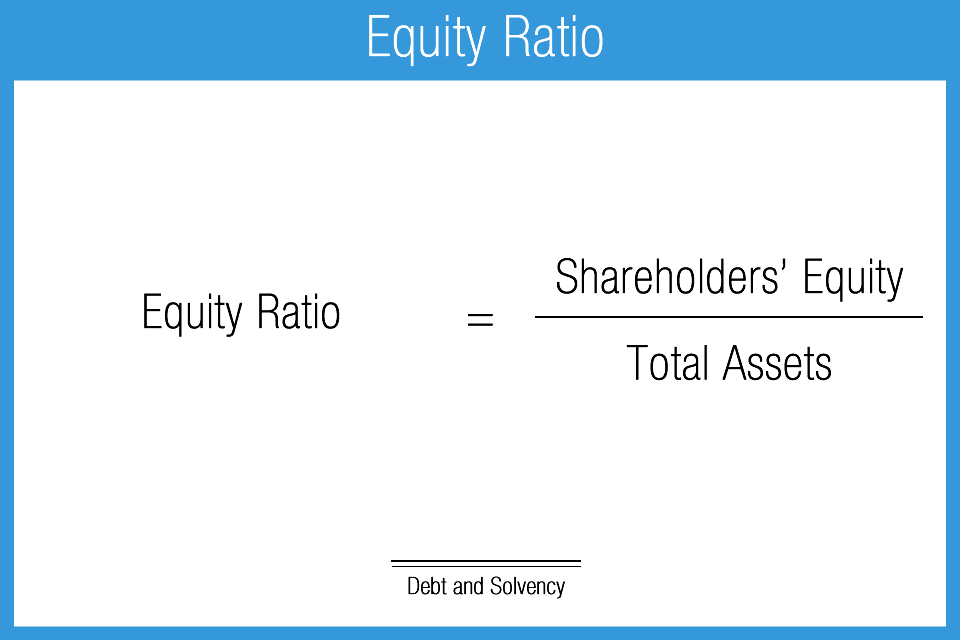

Additionally, benchmarking these ratios against industry peers provides a more comprehensive assessment of the companies’ capital structures and financial health. The Debt to Equity ratio is a financial metric that compares a company’s total debt to its shareholder equity. A lower debt to equity ratio usually implies a more financially stable business.

A company with a higher ratio than its industry average, therefore, may have difficulty securing additional funding from either source. The debt-to-equity ratio (D/E) is a financial leverage ratio that can be helpful when attempting to understand a company’s economic health and if an investment is worthwhile or not. It is considered to be a gearing ratio that compares the owner’s equity or capital to debt, or funds borrowed by the company. Creditors view a higher debt to equity ratio as risky because it shows that the investors haven’t funded the operations as much as creditors have. In other words, investors don’t have as much skin in the game as the creditors do.

This ratio indicates how much debt a company is using to finance its assets compared to equity. A high ratio may suggest higher financial risk, while a low ratio indicates less risk. A business that ignores debt financing entirely may be neglecting important growth opportunities. The benefit of debt capital is that it allows businesses to leverage a small amount of money into a much larger sum and repay it over time. This allows businesses to fund expansion projects more quickly than might otherwise be possible, theoretically increasing profits at an accelerated rate. The D/E ratio can be skewed by factors like retained earnings or losses, intangible assets, and pension plan adjustments.