Accountants are responsible for using the same standards and practices for all accounting periods. If a method or practice is changed, or if you hire a new accountant with a different system, the change must be fully documented and justified in the footnotes of the financial statements. This principle ensures that any company’s internal financial documentation is consistent over time. Publicly traded domestic companies are required to follow GAAP guidelines, but private companies can choose which financial standard to follow. Some companies in the U.S.—particularly those that are traded internationally or see a lot of international business—may use dual reporting (i.e., both methods) when preparing financial statements.

Principle of Periodicity

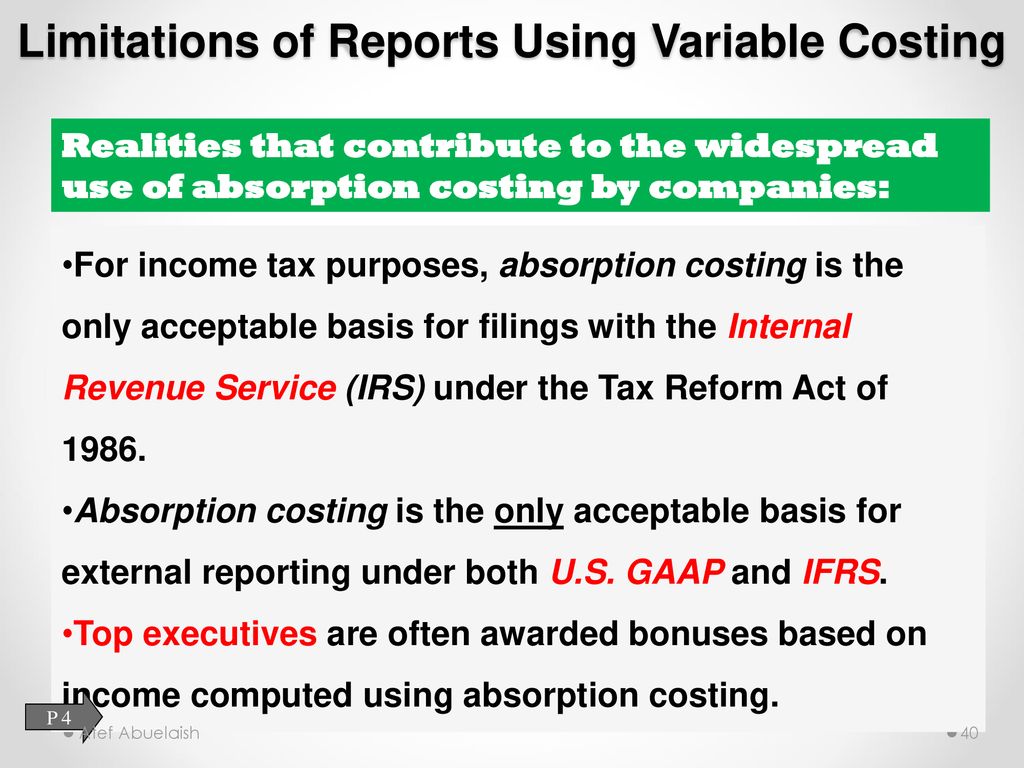

This eliminates the distinctions between fixed and variable costs, thereby reflecting the impact of overhead on manufacturing. Both costing methods can be used by management to make manufacturing decisions. Both can also be used for internal accounting purposes to value work in progress and finished inventory. The absorption costing method is typically the standard for most companies with COGS. Auditors and financial stakeholders will require it for external reporting.

Brief Overview of GAAP (Generally Accepted Accounting Principles)

Full absorption costing–also called absorption costing–is an accounting method that captures all of the costs involved in manufacturing a product. The costs can include both direct costs and indirect costs. Variable costing is a valuable management tool but debits and credits it isn’t GAAP-compliant and it can’t be used for external reporting by public companies. A company may also have to use absorption costing which is GAAP-compliant if it uses variable costing. The impact of absorption costing will depend on the business.

Cost Accounting for Ethical Business Managers

A business may use variable costing in order to more easily derive its contribution margin, which is net sales minus all variable costs. The contribution margin is a key input into the breakeven calculation, which is used to derive the sales level at which a business generates a zero profit. This, in turn, is useful for calculating the number of units that must be sold in order to break even, and so drives the pricing and product positioning strategy of a business. Under both methods, direct costs (materials and labor) and variable factory overhead costs are applied to the cost of the product. The difference between the two costing methods is how the fixed factory overhead costs are treated.

If the 8,000 units are sold for $33 each, the difference between absorption costing and variable costing is a timing difference. Under absorption costing, the 2,000 units in ending inventory include the $1.20 per unit share, or $2,400 of fixed cost. That cost will be expensed when the inventory is sold and accounts for the difference in net income under absorption and variable costing, as shown in Figure 6.14. Generally accepted accounting principles require use of absorption costing (also known as “full costing”) for external reporting. Under absorption costing, normal manufacturing costs are considered product costs and included in inventory.

- The cost accountant should be calculating the variances between the actual cost of goods sold and recording the variances within the cost of goods sold in every reporting period.

- Want to know if making more stuff will boost profits?

- Any company can use both methods for various reasons but public companies are required to use absorption costing due to their GAAP accounting obligations.

- The difference in the methods is that management will prefer one method over the other for internal decision-making purposes.

- The variable costing approach ignores such fixed manufacturing costs, thereby understating the overall cost of the product.

- Absorption costing is also known as full costing.

F Variable costing always treats fixed manufacturing overhead as a period cost. Thus all fixed manufacturing overhead costs are expensed in the period incurred regardless of the level of sales. F Variable costing treats fixed manufacturing overhead as a period cost. Assume each unit is sold for $33 each, so sales are $330,000 for the year. If the entire finished goods inventory is sold, the income is the same for both the absorption and variable cost methods.

If there is any additional or relevant information needed to understand the financial reports, it must be fully disclosed in the notes, footnotes or description of the report. The more precise your allocation, the happier they are. It’s all about painting an accurate financial picture. You can’t just slap a «made in overhead» sticker on each product. You can see exactly how changes in sales affect your bottom line. It’s like having X-ray vision for your business.

Additionally, fixed overhead is $15,000 per year, and fixed sales and administrative expenses are $21,000 per year. Figure 6.11 presents the results for each costing method. Using variable costing, the $40,000 in fixed manufacturing overhead costs continues to be expensed when incurred. Thus when fewer units are produced than are sold, absorption costing results in higher costs and lower profit. Figure 6.10 presents the results for each costing method.

Variable costing might look tempting, but it’s not your friend when it comes to external reporting. In a traditional income statement, you lump all your costs together. We’re diving into the clash of the costing titans. You’re about to see how these two methods duke it out in the financial arena.